rejekibet.ru Tools

Tools

Loan To Pay Off Student Loan Debt

Get clear on what you owe · Increase your monthly payments if possible · Consider consolidating your debts · Reevaluate your repayment plan · Take advantage of. Credit counseling nonprofits, which are different from credit repair companies, can help you make a plan to get out of debt. You can look for one near you by. You will likely have a variety of repayment options, from a standard ten-year plan, to extended plans that base your payments on how much you earn. There are also graduate repayment plans that slowly ramp up monthly payments over time, presumably in conjunction with projected salaries as people progress. You must begin to repay the federal portion of your student loan six months after the last date you attended school on a full-time basis. Paying more than the minimum, signing up for autopay and refinancing are just three ways you can accelerate your student debt payoff. Select explains how. Find out how to make your student loan payments on time while keeping the cost manageable. Learn about repayment programs, forgiveness plans, and more. Another way to speed up your student loan repayment is by making lump-sum payments. How do you do that when you're already behind? By using found money. Found. Repaying student loans? See tips for reducing debt, explore repayment plans, and learn about loan forgiveness programs. Explore your options to pay off. Get clear on what you owe · Increase your monthly payments if possible · Consider consolidating your debts · Reevaluate your repayment plan · Take advantage of. Credit counseling nonprofits, which are different from credit repair companies, can help you make a plan to get out of debt. You can look for one near you by. You will likely have a variety of repayment options, from a standard ten-year plan, to extended plans that base your payments on how much you earn. There are also graduate repayment plans that slowly ramp up monthly payments over time, presumably in conjunction with projected salaries as people progress. You must begin to repay the federal portion of your student loan six months after the last date you attended school on a full-time basis. Paying more than the minimum, signing up for autopay and refinancing are just three ways you can accelerate your student debt payoff. Select explains how. Find out how to make your student loan payments on time while keeping the cost manageable. Learn about repayment programs, forgiveness plans, and more. Another way to speed up your student loan repayment is by making lump-sum payments. How do you do that when you're already behind? By using found money. Found. Repaying student loans? See tips for reducing debt, explore repayment plans, and learn about loan forgiveness programs. Explore your options to pay off.

Make extra payments when possible and explore potential lower rates through consolidation for debt other than student loans. Meanwhile, paying off private student loans with a HELOC may provide lower interest rates and a reduction in the number of payments. If you have private student. The Repayment Assistance Plan helps borrowers manage debt by calculating an affordable monthly payment that is based on family income and student loan debt. Where to repay your loan. You'll be making payments to the National Student Loans Service Centre (NSLSC), not to OSAP. For further details about the repayment. The Public Service Loan Forgiveness (PSLF) program forgives the remaining balance on your federal student loans after payments working full time for federal. Pay down debt faster and save on interest costs by consolidating your balances into a line of credit or loan with a lower interest rate. About 92% of outstanding loans are federal student debt, and these come with many repayment plan options you can change at any time. You can use the Federal. Understand loan repayment. Find what you need to know about your student loans and repayment. ; If you miss loan payments. Find out what to do if you're behind. Pay the minimum on all loans every month. Direct the additional money to go to the loan with the highest interest rate. If two loans have the. 1. Understand how your student loan debt will affect your future · 2. Start making student loan payments while you're still in school · 3. Return your financial. 2. Look into career-focused repayment and forgiveness programs Based on your career and/or degree, you may qualify for student loans that offer lower interest. Know how much you owe · Make it automatic · Pay off debt with higher interest rates first · Consolidate · Know when to ask for help · Empower yourself with financial. Target your highest-interest loans for prepayment first and then work your way down as loans are paid off. That way, you'll save more in interest payments. Federal student loans offer multiple repayment plans, depending on your financial situation. They include standard, graduated, extended and income-based. Borrowers must also have high debt relative to their income. How it works: Monthly payments are either 10% or 15% of discretionary income, based on when you. Navigate the student loan repayment process with confidence: make payments, change repayment plans, explore options, and get help. Use Your Tax Refund One easy way to pay off your loan faster is to dedicate your tax refund to paying off some of your student loan debt. Part of the reason. Now, if your primary loan is through the National Student Loans Centre, you'll have a grace period of six months after you graduate before repayment begins. You can make payments before they are due or pay more than the amount due each month. Paying a little extra each month can reduce the interest you pay and. How to pay off student loans · 1. Enroll in the extended student loan repayment plan · 2. Make additional payments · 3. Reduce your interest rates through.

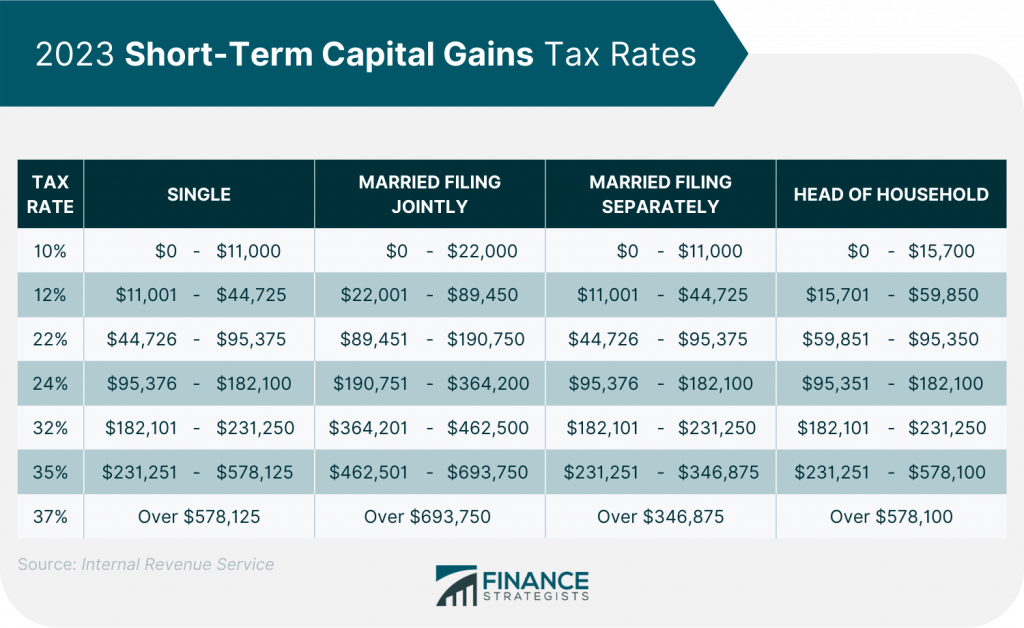

Long Term Gains Tax

A capital gains tax is levied on the profit made from selling an asset and is often in addition to corporate income taxes. Learn more. Long-term capital gains generally qualify for a tax rate of 0%, 15%, or 20%. Under the Tax Cuts and Jobs Act of , long-term capital gains tax rates are. Long-term capital gains are gains on assets you hold for more than one year. They're taxed at lower rates than short-term capital gains. Depending on your. Biden's FY25 budget proposal would nearly double that capital gains tax rate to %. That proposed capital gains rate increase would apply to investors who. One prominent proposal would be to tax capital gains as they accrue instead of waiting until an asset is sold, an approach sometimes known as “mark-to-market.”. Long-term capital gains are taxed at a lower rate than your ordinary income, taxation on long-term investment profits is more favorable than taxation on your. Depending on your income level, and how long you held the asset, your capital gain on your investment income will be taxed federally between 0% to 37%. A 7% tax on the sale or exchange of long-term capital assets such as stocks, bonds, business interests, or other investments and tangible assets. Gains from the sale of collectibles, such as art, antiques, coins, and precious metals, are subject to a higher long-term capital gains tax rate of 28%. Whereas. A capital gains tax is levied on the profit made from selling an asset and is often in addition to corporate income taxes. Learn more. Long-term capital gains generally qualify for a tax rate of 0%, 15%, or 20%. Under the Tax Cuts and Jobs Act of , long-term capital gains tax rates are. Long-term capital gains are gains on assets you hold for more than one year. They're taxed at lower rates than short-term capital gains. Depending on your. Biden's FY25 budget proposal would nearly double that capital gains tax rate to %. That proposed capital gains rate increase would apply to investors who. One prominent proposal would be to tax capital gains as they accrue instead of waiting until an asset is sold, an approach sometimes known as “mark-to-market.”. Long-term capital gains are taxed at a lower rate than your ordinary income, taxation on long-term investment profits is more favorable than taxation on your. Depending on your income level, and how long you held the asset, your capital gain on your investment income will be taxed federally between 0% to 37%. A 7% tax on the sale or exchange of long-term capital assets such as stocks, bonds, business interests, or other investments and tangible assets. Gains from the sale of collectibles, such as art, antiques, coins, and precious metals, are subject to a higher long-term capital gains tax rate of 28%. Whereas.

Russia · Capital gains of individual taxpayers are tax free if the taxpayer owned the asset for at least three years. · Capital gains of resident corporate. For the sake of simplicity, let's use a 20% tax rate in this example. This is the top long-term capital gains tax rate at the federal level (excluding the %. Updated Capital gains tax by state table for each state in the country and D.C.. Capital gains state tax rates displayed include federal max rate at. While all capital gains are taxable and must be reported on your tax return, only capital losses on investment or business property are deductible. Losses. Capital gains: In Canada, only 50% of the total capital gains is taxable. It is included in your annual taxable income and taxed at your marginal tax rate. Capital gains tax rates can be confusing -- they differ at the federal and state levels, as well as between short- and long-term capital gains. You may claim a credit for the short-term and long-term capital gain on a transaction if: There is no form for this credit. Keep all related documents with. Short-Term Capital Gains Tax Rates Short-term capital gains are taxed as ordinary income. Any income that you receive from investments that you held for one. Use tax-advantaged accounts. An easy and impactful way to reduce your capital gains taxes is to use tax-advantaged accounts. Retirement accounts such as (k). Capital Gains Tax. In most cases, capital gains tax is paid after selling an asset (like stocks or real estate). This usually happens when you file your tax. Learn how capital gains tax works, how to calculate, & determine the difference between short-term and long-term tax rates with H&R Block. They're subject to a 0%, 15%, or 20% tax rate, depending on your level of taxable income. Short-term capital gains are gains on investments you owned 1 year or. Capital gains are triggered when you sell your investment for a higher price than your book value (also called adjusted cost base or ACB). Your book value is. Other sold assets will be taxed at long-term capital gains rates. The Federal rates are 0%, 15%, or 20%, depending on filing status and taxable income. Each. Long-term capital gains are profits from selling assets you own for more than a year. They're usually taxed at lower long-term capital gains tax rates (0%, 15%. Short-term capital gains are taxed at the investor's ordinary income tax rate and are defined as investments held for a year or less before being sold. Long-. Short-term capital gains (for assets held for less than a year) are typically taxed at your ordinary income tax rate, which can range from 10% to 28%. The tax rate depends on the type of asset, the taxpayer's taxable income, how long the taxpayer held the asset, and when the taxpayer sold the asset. Capital. "Net long-term capital gains" means net long-term capital gains as that term is defined in section of the Internal Revenue Code, 26 USC How does the federal government tax capital gains income? Four maximum federal income tax rates apply to most types of net long-term capital gains income in tax.

Top Stocks Premarket

Some popular examples are Robinhood, TD Ameritrade and E*Trade. It's usually best to trade with limit orders during the premarket, due to lower trading volumes. XRTX, , %, M, Top Gainers · BCDA, , %, M, Top Gainers · LUCY, , %, M, Top Gainers. Premarket trading coverage for US stocks including news, movers, losers and gainers, upcoming earnings, analyst ratings, economic calendars and futures. S&P - Top Gainers ; Best Buy, , ; West Pharmaceutical Services, , ; Albemarle, , ; Bio. Pre-Market Trading session and After Hours Trading session. These are The quotes you receive are consolidated and represent the best available prices across. Top Africa Lender Standard Bank Shuffles Senior-Executive Roles Japan Stocks Trading Value Hits Record on Foreign Buying, MSCI · Markets Wrap. Premarket Gainers ; 6, DLTH, Duluth Holdings Inc. ; 7, AFRM, Affirm Holdings, Inc. ; 8, NTNX, Nutanix, Inc. ; 9, BBY, Best Buy Co., Inc. Premarket Losers ; 1, NBIX, Neurocrine Biosciences, Inc. ; 2, NCNO, nCino, Inc. ; 3, ANF, Abercrombie & Fitch Co. ; 4, EVTV, Envirotech Vehicles, Inc. Pre-market stock trading coverage from CNN. Get the latest updates on pre-market movers, S&P , Nasdaq Composite and Dow Jones Industrial Average futures. Some popular examples are Robinhood, TD Ameritrade and E*Trade. It's usually best to trade with limit orders during the premarket, due to lower trading volumes. XRTX, , %, M, Top Gainers · BCDA, , %, M, Top Gainers · LUCY, , %, M, Top Gainers. Premarket trading coverage for US stocks including news, movers, losers and gainers, upcoming earnings, analyst ratings, economic calendars and futures. S&P - Top Gainers ; Best Buy, , ; West Pharmaceutical Services, , ; Albemarle, , ; Bio. Pre-Market Trading session and After Hours Trading session. These are The quotes you receive are consolidated and represent the best available prices across. Top Africa Lender Standard Bank Shuffles Senior-Executive Roles Japan Stocks Trading Value Hits Record on Foreign Buying, MSCI · Markets Wrap. Premarket Gainers ; 6, DLTH, Duluth Holdings Inc. ; 7, AFRM, Affirm Holdings, Inc. ; 8, NTNX, Nutanix, Inc. ; 9, BBY, Best Buy Co., Inc. Premarket Losers ; 1, NBIX, Neurocrine Biosciences, Inc. ; 2, NCNO, nCino, Inc. ; 3, ANF, Abercrombie & Fitch Co. ; 4, EVTV, Envirotech Vehicles, Inc. Pre-market stock trading coverage from CNN. Get the latest updates on pre-market movers, S&P , Nasdaq Composite and Dow Jones Industrial Average futures.

The overview page shows the top Pre-Market Volume Leaders, Pre-Market Percent Advances and Declines, and Pre-Market Gap Ups and Gap Downs. Earnings: Stocks. Top Gainers - United States Stocks ; XORTX Therapeutics. |XRTX. + ; Innovative Eyewear. |LUCY. + ; Affirm Holdings. While pre-market gappers have high volatility, the combination of high volatility and higher than average volume is typically best for trading. How to Trade. After-hours trading takes place after the trading day for a stock exchange. It allows you to buy or sell stocks outside of normal trading hours. Explore stocks with significant price movement or volume before regular trading begins. Here's what to keep in mind with after hours: extremely low volumes in most cases. That means that it will sometimes cause the best offering. Top After-Hours Stock Gainers ; PCVX. Vaxcyte. $, $, %, K ; ASTH. Astrana Health. $, $, %, K. TOP GAINERS ; PANW · Palo Alto Networks Inc. , % ; QRVO · Qorvo Inc. , % ; MKTX · Marketaxess Holdings Inc. , %. Top Gainers - United States Stocks ; XORTX Therapeutics. |XRTX. + ; Innovative Eyewear. |LUCY. + ; Affirm Holdings. Biggest movers among U.S.-listed issues outside of regular trading hours with a minimum share price of $2 and minimum pre-market or after-hours volume of. Pre-Market ; Affirm Holdings, Inc. · Tesla, Inc. · Apple Inc. · PDD Holdings Inc. ; $ · $ · $ · $ Most actively traded US stocks in pre-market ; BBY · K · USD ; AMZN · K · USD ; UBXG · K · USD ; WULF · K · USD. US stocks with the biggest gap in pre-market ; AAZI · +%, USD ; DLTH · +%, USD ; AEHL · +%, USD ; AFRM · +%, USD. Get the latest after-hours stock market quote data from Nasdaq. Top Gainers ; Innovative Eyewear Inc. LUCY. +%. M · %. M ; Xortx Therapeutics Inc. XRTX. +%. Stocks ; NVDA NVIDIA Corporation. (%). , %, M ; INND InnerScope Hearing Technologies, Inc. (%). -, -, M. It may be best to wait to see if it's going to keep falling or start rallying. One way to protect yourself against further declines is to set a stop order. Trading stocks during after-hours trading sessions can have a big effect on the price that an investor will pay. NASDAQ Top Gainers (%) ; TOIIW. % ; VRAX. %. NASDAQ - Premarket movers by Most Active, Top Gainers, Top Losers and Volume Trading Tools Expand More Icon. Economic Calendar · Alerts.

Best Diy Estate Planning

Do-it-yourself Wills and Trusts have become hugely popular. You can find them at estate planning websites such as LegalZoom, Nolo or BuildaWill. The Best Benefit Is Peace of Mind Knowing you have a properly prepared plan in place—one that contains your instructions and will protect your family—will. Best Overall: Nolo's Quicken WillMaker & Trust · Best Value: U.S. Legal Wills · Best for Ease of Use: Trust & Will · Best Comprehensive Estate Plan: TotalLegal. People who use LegalZoom and other DIY estate planning kits end up with a false sense of security. And we take great care to keep abreast on issues affecting. An annual review is best, but it's fine to just check it every few years if you have a simple will and a small estate. Call Arizona Estate Attorney Dave Weed at. More detailed information is available from the California State Bar: Estate planning · Wills · Trusts. Back To Top. Search Consumer. A discussion of what consumers need to know about using do-it-yourself estate planning documents and DIY wills. Try the #1 estate planning software. Nolo's Quicken WillMaker Plus is the easiest way to create your estate plan, whether you're just getting started or you. Try the #1 estate planning software. Nolo's Quicken WillMaker Plus is the easiest way to create your estate plan, whether you're just getting started or you. Do-it-yourself Wills and Trusts have become hugely popular. You can find them at estate planning websites such as LegalZoom, Nolo or BuildaWill. The Best Benefit Is Peace of Mind Knowing you have a properly prepared plan in place—one that contains your instructions and will protect your family—will. Best Overall: Nolo's Quicken WillMaker & Trust · Best Value: U.S. Legal Wills · Best for Ease of Use: Trust & Will · Best Comprehensive Estate Plan: TotalLegal. People who use LegalZoom and other DIY estate planning kits end up with a false sense of security. And we take great care to keep abreast on issues affecting. An annual review is best, but it's fine to just check it every few years if you have a simple will and a small estate. Call Arizona Estate Attorney Dave Weed at. More detailed information is available from the California State Bar: Estate planning · Wills · Trusts. Back To Top. Search Consumer. A discussion of what consumers need to know about using do-it-yourself estate planning documents and DIY wills. Try the #1 estate planning software. Nolo's Quicken WillMaker Plus is the easiest way to create your estate plan, whether you're just getting started or you. Try the #1 estate planning software. Nolo's Quicken WillMaker Plus is the easiest way to create your estate plan, whether you're just getting started or you.

When visiting their site's Estate Planning section, you can see a variety of services on offer. These range from living trusts and wills to establishing an iron. The revocable living trust is primarily a vehicle for managing your property during your lifetime, including even if you become incapacitated, and might also. Washington Wills is a legal resource with free forms and instructions to help Washingtonians draft their own wills and other estate plan documents. NC Online Estate Plans, brought to you by The Elderlaw Firm, is ideal if you'd like a “do-it-yourself” option to have properly drafted, up-to-date legal. For a complete estate planning service that is customizable to your exact situation, Gentreo offers a way to create, store and share your estate plan. If you. Purchase an affordable Estate Plan Bundle that includes two last wills or a living trust, financial power of attorney, living will, and one year of attorney. DIY Will with an online Estate Planning platform like Trust & Will. You'll learn: DIY Will Pros & Cons. Are Online Wills Legitimate? Best Online Will Maker. If you want a DIY option for more complicated wills, TotalLegal is your best bet. This service offers a wealth of legal documents for estate planning and. Nolo offers a range of estate planning products for every stage of life. Whether you're looking for a do-it-yourself will or trust. Our FREE Personal Estate Planning Kit is a tool for organizing your estate — saving you time, protecting your assets, and helping you establish your legacy. The Dangers of DIY Estate Planning Documents A DIY situation that's supposed to save money can easily result in estate losses of tens of thousands of dollars. Do-it-yourself Wills and Trusts have become hugely popular. You can find them at estate planning websites such as LegalZoom, Nolo or BuildaWill. For most parents, online wills work well on their own. If your estate plan is complex — meaning that it involves multiple beneficiaries, trusts or tax. Estate Planning Basics A good estate plan helps protects your family and your property when you die or become incapacitated. Planning your estate generally. The revocable living trust is primarily a vehicle for managing your property during your lifetime, including even if you become incapacitated, and might also. Trust & Will is an online estate planning documentation generation tool, from the company of the same name in San Diego, California. Sole proprietors can use. Simple. Easy. Trusted. Create a will, trust, or power of attorney in minutes with WillMaker's online DIY estate planning software. Our FREE Personal Estate Planning Kit is a tool for organizing your estate — saving you time, protecting your assets, and helping you establish your legacy. When you choose Estate Plan Express, you can plan for the future from the comfort of your home on your own schedule. Using our user-friendly, straightforward.

Best Ways To Make Money From Home

Flog on eBay for best prices · Sell on Vinted with no fees · Sell for free on Facebook · Get quick cash for old CDs, games & more · Flog tech 'leftovers', such as. 15 Ways to Make Money as a Stay-At-Home Mom · 1. Start a Print-On-Demand Business · 2. Try Affiliate Marketing · 3. Become a Digital Expert · 4. Sell an Online. Ways to Make Money From Home · 1. Account Management Jobs · 2. Accounting & Finance Jobs · 3. Administrative Jobs · 4. Art & Creative Jobs · 5. Bilingual Jobs · 6. Helping a pooch get some exercise and/or looking after them is a great way to make some extra cash – especially if you're responsible for more than one. Take Online Surveys. Earning potential: $1 to $50 per month. If you're looking for a flexible way to earn extra money from home. This is another best way to earn money by sitting at home. As the number of solopreneurs is increasing, so is the demand for virtual assistants. A virtual. House and pet sitting can be a good way to make money fast, especially if you enjoy spending time with animals and have a flexible schedule. Again, you can. If you have a few extra hours per week and can landscape with the best of them, consider starting up a lawn or garden business. Many people view weed-eating and. Drop shipping is an excellent way to make money from home without the hassle of inventory. Set up an online store and partner with suppliers who handle. Flog on eBay for best prices · Sell on Vinted with no fees · Sell for free on Facebook · Get quick cash for old CDs, games & more · Flog tech 'leftovers', such as. 15 Ways to Make Money as a Stay-At-Home Mom · 1. Start a Print-On-Demand Business · 2. Try Affiliate Marketing · 3. Become a Digital Expert · 4. Sell an Online. Ways to Make Money From Home · 1. Account Management Jobs · 2. Accounting & Finance Jobs · 3. Administrative Jobs · 4. Art & Creative Jobs · 5. Bilingual Jobs · 6. Helping a pooch get some exercise and/or looking after them is a great way to make some extra cash – especially if you're responsible for more than one. Take Online Surveys. Earning potential: $1 to $50 per month. If you're looking for a flexible way to earn extra money from home. This is another best way to earn money by sitting at home. As the number of solopreneurs is increasing, so is the demand for virtual assistants. A virtual. House and pet sitting can be a good way to make money fast, especially if you enjoy spending time with animals and have a flexible schedule. Again, you can. If you have a few extra hours per week and can landscape with the best of them, consider starting up a lawn or garden business. Many people view weed-eating and. Drop shipping is an excellent way to make money from home without the hassle of inventory. Set up an online store and partner with suppliers who handle.

Are you skilled in crafting unique items like jewelry, clothing, or home decor? Turn your passion into profit by selling your creations on local markets or. Helping a pooch get some exercise and/or looking after them is a great way to make some extra cash – especially if you're responsible for more than one. Some people earn good money by signing up as a delivery driver through apps like Uber Eats, Amazon Flex, or DoorDash. These apps allow you to set up your own. Paid Online Surveys. How much can you make: Earn $5 per survey. Online Surveys are a great way to make money while loading Netflix or when you'. Things like freelancing, social media marketing, answering surveys, and proofreading for other small businesses are pretty easy side jobs from home that can. Blogging. Blogging is #1 on the list because it is one of the most flexible jobs you can have and the earning potential is limitless! Blogging. If you are good, you can build a following. Once your following is big enough, companies will pay you to promote their products or services on your blog through. Online surveys can be a great way to earn money from home. Survey sites offer opportunities for people to earn cash or rewards by taking surveys. Here are some. Sell Products From Home. While multi-level-marketing (MLM) companies sometimes get a bad rap, they can actually be a great way to earn additional income from. This is another best way to earn money by sitting at home. As the number of solopreneurs is increasing, so is the demand for virtual assistants. A virtual. One easy way to earn money from home is to help others complete tasks as a part-time virtual assistant. If you're highly organized and can properly manage your. Download and use a browser extension There's a very simple way to earn money for searching what you otherwise would be looking for on search engines Google or. How it works: Do you have storage space in your house? Or maybe an empty garage or shed? You could rent out these spaces on rejekibet.ru, which is sort of like. Certain types of sites perform better than others when it comes to generating Google AdSense revenue. The two things you need to make money with AdSense are. If you are good, you can build a following. Once your following is big enough, companies will pay you to promote their products or services on your blog through. The most straightforward method to monetize a blog is through AdSense— Google's advertising platform. Running ads on your own website enables you to earn income. 20+ legit ways to earn money online using the top paying websites and apps. Lots of interesting methods to earn cash on the web in your free time. Doing odd jobs is a quick and easy way to earn money. Similarly, reselling items or selling items you make can earn you extra cash. As another option, earn. You can search for micro-jobs if you're looking for easy side gigs to make money online occasionally. For example, transcribing would be a solid option for you. Become a virtual assistant to earn money online. One of the most real ways to make money from home for free is to become a virtual assistant. This is something.

Leaseback Invest

This is how sale-leasebacks usually work in commercial real estate, where companies often use them to free up capital that's tied up in a real estate investment. LeaseBack Invest, Brno, Czech Republic. 51 likes. LeaseBack Invest s.r.o. se specializuje na zpětný leasing nemovitostí, výkup nemovitostí, dlouh. A sale-leaseback is a transaction in which a property owner sells their real estate to an investor or company, and then leases the property back from the new. Sale Leaseback. VANDERSTELT connects buyers and investors to obtain the optimal profit from a sale and leaseback construction. We bring large firm investment banking capabilities to what is typically viewed as a real estate marketing business. We consider sale leasebacks as "M&A-light,". In addition, timing is key if your organization intends to invest the sale proceeds in financial markets or new property. Strive to achieve maximum value. A sale-leaseback is a transaction in which an investor buys a property that is already being owned and operated by someone else. For a company which views its core competency as something other than real estate, executing a sale-leaseback can provide them the opportunity to invest the. Sale leasebacks (“SLBs”) can be a highly attractive capital allocation tool with many strategic and financial drivers to consider (see our Insight). When. This is how sale-leasebacks usually work in commercial real estate, where companies often use them to free up capital that's tied up in a real estate investment. LeaseBack Invest, Brno, Czech Republic. 51 likes. LeaseBack Invest s.r.o. se specializuje na zpětný leasing nemovitostí, výkup nemovitostí, dlouh. A sale-leaseback is a transaction in which a property owner sells their real estate to an investor or company, and then leases the property back from the new. Sale Leaseback. VANDERSTELT connects buyers and investors to obtain the optimal profit from a sale and leaseback construction. We bring large firm investment banking capabilities to what is typically viewed as a real estate marketing business. We consider sale leasebacks as "M&A-light,". In addition, timing is key if your organization intends to invest the sale proceeds in financial markets or new property. Strive to achieve maximum value. A sale-leaseback is a transaction in which an investor buys a property that is already being owned and operated by someone else. For a company which views its core competency as something other than real estate, executing a sale-leaseback can provide them the opportunity to invest the. Sale leasebacks (“SLBs”) can be a highly attractive capital allocation tool with many strategic and financial drivers to consider (see our Insight). When.

If the sale leaseback meets the operating lease criteria, the asset column of the balance sheet reflects the transaction by replacing the investment in real. Leaseback, short for "sale-and-leaseback", is a financial transaction in which one sells an asset and leases it back for the long term; therefore. This allows the seller to offload the balance sheet from capital intensive real estate investments without disruption in the operations. Goodman is your trusted. The RICS definition of a sale and leaseback is an arrangement whereby an owner sells his/her interest in a property or piece of land for an. A sale-leaseback transaction is when a company sells its commercial property to an investor and then leases the property back from the investor. Early indications for suggest a growing return of confidence for the sale leaseback market as prices have widened. While sale leaseback real estate investors make up a small portion of overall private equity firms, they represent a substantial group of investors that. Unlock Equity & Raise Cash with Wangard's Sale-Leaseback Financing Program. Sale-leasebacks are a cost-efficient, effective financing tool that can help you. A sale leaseback transaction involves selling recently purchased assets to a lessor and getting reimbursed up to % of the original purchase price. The Mesirow Sale-Leaseback Capital capabilities spans sale-leaseback, build-to-suit development, ground leases and select existing net-lease. Earn monthly returns with a smart investment in our Show Home Leaseback Program!** Welcome to an innovative program designed to help you own a gorgeous new. A leaseback showhome is a unique investment opportunity where you purchase a model home that Park Royal Homes leases back from you. Today's low interest rate environment has increased fixed-income investor demand for alternative investments generating higher yields than traditional. In a sale-leaseback transaction, the property owner sells their interest in an investment property to a buyer for cash and agrees to rent it back from them. The. Unlock capital to invest back into your business. With a sales leaseback, you sell your equipment to a lender at fair market value and lease it back over a. Join our trusted network of practice professionals who have used a Sale-Leaseback to access the equity in their real estate to optimize practice value and. Sale and Leaseback. Do you have new projects? Refinance the assets that you already acquired to set free the liquidity, preserve your equity and lighten your. The low interest rates and low returns available with other investment opportunities are driving intense demand for long-term leased real estate. This demand. Companies consider sale-leaseback financing to address any number of capital needs, ranging from improving overall cost of capital, investing in corporate.

Putnam Equity Income Fund Class A

The plans provide for payments at annual rates (based on average net assets) of up to % on class A shares and % on class B, class C, class M and class R. Annualized performance (A shares) as of December 31, Portfolio: Putnam Ultra Short Duration Income Fund A Benchmark: ICE BofA U.S. Treasury Bill Ind Past. The fund seeks capital growth and current income by investing mainly in common stocks of US companies, with a focus on value stocks that offer the potential. The portfolio s holdings are subject to change without notice. The mention of specific securities is not a recommendation or solicitation for any person to. Get the lastest Class Information for Putnam Large Cap Value Fund Class A from Zacks Investment Research. Putnam Equity Income B, PEQNX Quick Quote PEQNX. Putnam International Equity Fund Class A. $ POVSX %. Putnam Focused Fidelity Growth & Income Portfolio. $ %. add_circle_outline. The fund invests mainly in common stocks of U.S. companies, with a focus on value stocks that offer the potential for capital growth, current income, or both. Get PEQSX mutual fund information for Putnam-Equity-Income-Fund-Class-R6, including a fund overview,, Morningstar summary, tax analysis, sector allocation. The fund places a distinct emphasis on companies that can grow their dividends and are able and willing to return cash to shareholders. A disciplined process. The plans provide for payments at annual rates (based on average net assets) of up to % on class A shares and % on class B, class C, class M and class R. Annualized performance (A shares) as of December 31, Portfolio: Putnam Ultra Short Duration Income Fund A Benchmark: ICE BofA U.S. Treasury Bill Ind Past. The fund seeks capital growth and current income by investing mainly in common stocks of US companies, with a focus on value stocks that offer the potential. The portfolio s holdings are subject to change without notice. The mention of specific securities is not a recommendation or solicitation for any person to. Get the lastest Class Information for Putnam Large Cap Value Fund Class A from Zacks Investment Research. Putnam Equity Income B, PEQNX Quick Quote PEQNX. Putnam International Equity Fund Class A. $ POVSX %. Putnam Focused Fidelity Growth & Income Portfolio. $ %. add_circle_outline. The fund invests mainly in common stocks of U.S. companies, with a focus on value stocks that offer the potential for capital growth, current income, or both. Get PEQSX mutual fund information for Putnam-Equity-Income-Fund-Class-R6, including a fund overview,, Morningstar summary, tax analysis, sector allocation. The fund places a distinct emphasis on companies that can grow their dividends and are able and willing to return cash to shareholders. A disciplined process.

The Fund Putnam Equity Income Fund Class A has the ticker symbol PEYAX. The latest price for PEYAX is with net assets at. The Year-to-Date performance is. Putnam Equity Income Fund is composed primarily of stocks of large U.S. companies that pay dividends to their shareholders. In addition to targeting. Portfolio. Create a New Portfolio. CancelCreate. Added to a new portfolio successfully. Be the first to comment on Putnam Equity Income A. Add a Comment. Please. Share class. Management fees. Distribution and service. (12b-1) fees. Other expenses. Total annual fund operating expenses. Class IA. %. N/A. %. %. For class A and M shares, the current maximum initial sales charges are % and % for equity funds and % and % for income funds. Replace Putnam Equity Income A (PEYAX) with Putnam Equity Income Y (PEIYX). 1) Share Class Changes - Scott Sutherland presented a list of mutual funds that. PUTNAM EQUITY INCOME FUND CLASS A SHARES (PEYAX) has announced a dividend of $ with an ex date of March 07, and a payment date of March 11, The investment seeks high current income consistent with prudent risk. Strategy. The fund invest mainly in bonds that are securitized debt instruments . Equity. Category. Investment Policy. The investment seeks capital growth and current income. The fund invests mainly in common stocks of U.S. companies, with a. Get the lastest Class Information for Putnam Large Cap Value Fund Class R6 from Zacks Investment Research. Putnam Equity Income B, PEQNX Quick Quote PEQNX. The fund invests mainly in common stocks of U.S. companies, with a focus on value stocks that offer the potential for capital growth, current income. The fund seeks high current income consistent with what the portfolio managers believe to be prudent risk by investing across all sectors of the US bond market. Find the latest Putnam Equity Income Fund Class M (PEIMX) stock quote, history, news and other vital information to help you with your stock trading and. Asset Class FocusEquity. Fund Manager(s)Darren A Jaroch. Top Holdings. Name Putnam Equity Income Fund One Post Office Square Boston, MA Website. MyPlanIQ Fund Center provides the news, the performance statistics data, total return chart and other analytic tools for all mutual funds, CEFs and ETFs. Get Putnam Large Cap Value Fund Class A (PEYAX:NASDAQ) real-time stock 6/15/ PEYAX Fund details. Category, Equity Income. Style, Equity. CNBC logo. Putnam Equity Income R6. Add a Comment. Please wait a minute before you try to comment again. Post Cancel. Discussion. Show more replies(XX). Write a reply. The investment seeks capital growth and current income. The fund invests mainly in common stocks of US companies, with a focus on value stocks. This page shows a list of all the recent 13F filings made by PEYAX - PUTNAM EQUITY INCOME FUND Class A Shares. Form 13F is required to be filed within If it did, expenses would be higher. Annual fund operating expenses expenses you pay each year as a percentage of the value of your investment).

After Hours Nyse Trading

Monitor leaders, laggards and most active stocks during after-market hours trading. Low-latency, real-time market data feeds cover the various asset classes and markets in the NYSE Group to offer you insight into intraday trading activity. Pre-market trading generally happens from 8 am to am ET, though it can start earlier. After-hours trading starts at 4 pm and can run as late as 8 pm ET. In the post-market, fewer shares are required to make an impact, so traders use it to quickly adjust strategies. Sorted by post-market volume, US stocks below. The regular schedule for the New York Stock Exchange and Nasdaq is Monday through Friday from am to 4 pm Eastern time with weekends off. Today's market ; NYSE COMPOSITE (DJ), 19,, (%) ; NYSE U.S. INDEX, 16,, (%) ; DOW JONES INDUSTRIAL AVERAGE, 41, After-hours (post-market) trading is the period after the market closes when traders and investors can buy and sell securities. Check out what's happening in U.S. markets during after hours trading on CNBC Here are 3 things we're watching closely in the stock market this week · A. After-hours trading occurs after the markets close. There is also a session prior to the market's open which is called the pre-market session. Monitor leaders, laggards and most active stocks during after-market hours trading. Low-latency, real-time market data feeds cover the various asset classes and markets in the NYSE Group to offer you insight into intraday trading activity. Pre-market trading generally happens from 8 am to am ET, though it can start earlier. After-hours trading starts at 4 pm and can run as late as 8 pm ET. In the post-market, fewer shares are required to make an impact, so traders use it to quickly adjust strategies. Sorted by post-market volume, US stocks below. The regular schedule for the New York Stock Exchange and Nasdaq is Monday through Friday from am to 4 pm Eastern time with weekends off. Today's market ; NYSE COMPOSITE (DJ), 19,, (%) ; NYSE U.S. INDEX, 16,, (%) ; DOW JONES INDUSTRIAL AVERAGE, 41, After-hours (post-market) trading is the period after the market closes when traders and investors can buy and sell securities. Check out what's happening in U.S. markets during after hours trading on CNBC Here are 3 things we're watching closely in the stock market this week · A. After-hours trading occurs after the markets close. There is also a session prior to the market's open which is called the pre-market session.

The Post-Trading Session is from pm to pm. We closely monitor the New York Stock Exchange for changes to their trading hour. Any official changes will. The regular trading hours for the US stock market, which includes the Nasdaq Stock Market (Nasdaq) and the New York Stock Exchange (NYSE), are am to 4 pm. Stocks that are moving in the after hours trading period from PM to PM. See top gainers and top losers. Stay ahead in the game with our After-Hours Stock Market: Top Gainers and Losers. Get real-time insights into the stocks that are making moves after the. rejekibet.ru will report pre-market and after hours trades. Pre-Market trade data will be posted from am ET to am ET of the following day. When are after-hours quotes and trading available? · Canada (TSX + TSX Venture) from to pm ET · U.S. (NASDAQ + NYSE) from to pm ET. Stock After Hours Trading Report ; XLI, , , %, M. Extended trading on rejekibet.ru refers to the Pre-Market activity shown on the site from - AM (actual trading starts at AM EST) every trading day. When are after-hours quotes and trading available? · Canada (TSX + TSX Venture) from to pm ET · U.S. (NASDAQ + NYSE) from to pm ET. Extended Hours: p.m. to p.m. ET · p.m. ET - Limit Orders entered after p.m. ET are canceled. · p.m. ET - Portfolio Crossing System (PCS). After-hours trading refers to the period of time after the market closes and during which an investor can place an order to buy or sell stocks or ETFs. Since , the regular trading hours for major exchanges in the United States, such as the New York Stock Exchange and the Nasdaq stock market, have been from. After-hours trading provides market participants with the flexibility to execute and manage positions outside of the standard market hours of am to pm. Top gaining US stocks in post-market ; CDT · D · +%, USD ; MSGM · D · +%, USD ; IFIN · D · +%, USD ; TNFA · D · +%, USD. Typical after-hours trading hours in the U.S. are between 4 p.m. and 8 p.m. Eastern Time. An infographic showing after hours stock market trading hours, which. The NYSE is open from Monday through Friday a.m. to p.m. Eastern time. The NYSE may occasionally close early, either on a planned or unplanned basis. When you make a trade during overnight hours (between 8 PM AM ET), the trade date will actually be the next trading day. For example, if you buy 2 shares of. The equities and options exchanges have procedures for coordinated cross-market trading halts if a severe market price decline reaches levels that may exhaust. The NYSE is open from Monday through Friday a.m. to p.m. Eastern time. The NYSE may occasionally close early, either on a planned or unplanned basis.

Invesco S&P 500 Index Fund

The Fund seeks to deliver investment performance that corresponds, before expenses, to the total return of the S&P Fees. The Fund will invest at least 90% of its total assets in the securities that comprise the Index. The Index is compiled, maintained and calculated by Standard &. The fund invests, under normal circumstances, at least 80% of its net assets (plus any borrowings for investment purposes) in common stocks of companies. Invesco S&P Index A has securities in its portfolio. The top 10 holdings constitute % of the fund's assets. The fund meets the SEC requirement of. Find the latest performance data chart, historical data and news for Invesco S&P Index Fund Class A (SPIAX) at rejekibet.ru Invesco S&P Index Fund Class A. + + + + + + Category Average. + + + + + S&P TR USD. +. The investment seeks total return through growth of capital and current income. The fund invests, under normal circumstances, at least 80% of its net assets. Analyze the Fund Invesco S&P Index Fund Class C having Symbol SPICX for type mutual-funds and perform research on other mutual funds. The Invesco S&P ® Equal Weight ETF (Fund) is based on the S&P ® Equal Weight Index (Index). The Fund will invest at least 90% of its total assets in. The Fund seeks to deliver investment performance that corresponds, before expenses, to the total return of the S&P Fees. The Fund will invest at least 90% of its total assets in the securities that comprise the Index. The Index is compiled, maintained and calculated by Standard &. The fund invests, under normal circumstances, at least 80% of its net assets (plus any borrowings for investment purposes) in common stocks of companies. Invesco S&P Index A has securities in its portfolio. The top 10 holdings constitute % of the fund's assets. The fund meets the SEC requirement of. Find the latest performance data chart, historical data and news for Invesco S&P Index Fund Class A (SPIAX) at rejekibet.ru Invesco S&P Index Fund Class A. + + + + + + Category Average. + + + + + S&P TR USD. +. The investment seeks total return through growth of capital and current income. The fund invests, under normal circumstances, at least 80% of its net assets. Analyze the Fund Invesco S&P Index Fund Class C having Symbol SPICX for type mutual-funds and perform research on other mutual funds. The Invesco S&P ® Equal Weight ETF (Fund) is based on the S&P ® Equal Weight Index (Index). The Fund will invest at least 90% of its total assets in.

The Invesco S&P ® Momentum ETF (Fund) is based on the S&P Momentum Index (Index). The Fund generally will invest at least 90% of its total assets in the. The fund invests, under normal circumstances, at least 80% of its net assets (plus any borrowings for investment purposes) in common stocks of companies. SPIAX Mutual Fund Guide | Performance, Holdings, Expenses & Fees, Distributions and More. Get SPIDX mutual fund information for Invesco-S&PIndex-Fund-Class-Y, including a fund overview,, Morningstar summary, tax analysis. The Invesco S&P UCITS ETF Acc aims to provide the net total return performance of the S&P Index (the "Reference Index"), less the impact of fees. View the latest Invesco S&P Index Fund;A (SPIAX) stock price, news, historical charts, analyst ratings and financial information from WSJ. Invesco S&P Index Fund;A | historical charts and prices, financials, and today's real-time SPIAX stock price. Get the latest Invesco S&P Index Fund Class A (SPIAX) real-time quote, historical performance, charts, and other financial information to help you make. SPIDX | A complete Invesco S&P Index Fund;Y mutual fund overview by MarketWatch. View mutual fund news, mutual fund market and mutual fund interest. Get Invesco S&P Index Fund Class C (SPICX:NASDAQ) real-time stock quotes, news, price and financial information from CNBC. Invesco S&P ® Equal Weight ETF (RSP) is based on the S&P ® Equal Weight Index (Index). The Fund will invest at least 90% of its total assets in securities. Fees are Below Average compared to funds in the same category. Invesco S&P Index Fund has an expense ratio of percent. Complete Invesco S&P Index Fund;A funds overview by Barron's. View the SPIAX funds market news. Get the latest Invesco S&P Index Fund (SPIAX) price, news, buy or sell recommendation, and investing advice from Wall Street professionals. Performance charts for Invesco S&P Index Fund (SPIAX) including intraday, historical and comparison charts, technical analysis and trend lines. Index returns do not represent Fund returns. An investor cannot invest directly in an index. Neither the underlying Index nor the benchmark indexes charge. INVESCO S&P INDEX FUND CLASS A- Performance charts including intraday, historical charts and prices and keydata. Schwab S&P Index Fund; Shelton NASDAQ Index Direct; Invesco QQQ Trust ETF; Vanguard Russell ETF; Vanguard Total Stock Market ETF; SPDR Dow Jones. Get Invesco S&P Index Fund Class A (SPIAX:NASDAQ) real-time stock quotes, news, price and financial information from CNBC. The Fund will normally invest at least 90% of its total assets in common stocks that comprise the Index. The Index tracks the performance of stocks in the S&P.

Cambio De Dolar A Colombia

Current exchange rate US DOLLAR (USD) to COLOMBIAN PESO (COP) including currency converter, buying & selling rate and historical conversion chart. Use our currency converter to find the live exchange rate between COP and USD. Convert Colombian Peso to United States Dollar. FX: USD – COP Exchange Rates and Fees shown are estimates, vary by a number of factors including payment and payout methods, and are subject. Tasa de cambio EUR a USD · Convertor de Moneda: 1 EUR a USD · Gane dinero en la conversión de moneda! · Gráfico online EURUSD - Euro / Dólar · Simulador de. 1 COP = USD. TO = US Dollar (USD) 1 USD = COP. COP USD. Countries using this currency: Colombia,. Countries using this currency: American samoa. More Dólar dos EUA info. COP - Peso colombiano. Nosso ranking de moedas mostra que a taxa de câmbio mais procurada para Peso colombiano é de COP para USD. 1 USD = 4, COP Sep 14, UTC The currency converter below is easy to use and the currency rates are updated frequently. This is very much. La siguiente tabla muestra la historia del tipo de cambio entre Dólar Estadounidense y Peso Colombiano ; Tuesday 2 July , 1 USD = COP, USD COP tasa. Dollar Today in Colombia. Saturday September 14, $4, 1 Day: $ (%) 1 Week: $ (%) 1 Month: $ (%). Current exchange rate US DOLLAR (USD) to COLOMBIAN PESO (COP) including currency converter, buying & selling rate and historical conversion chart. Use our currency converter to find the live exchange rate between COP and USD. Convert Colombian Peso to United States Dollar. FX: USD – COP Exchange Rates and Fees shown are estimates, vary by a number of factors including payment and payout methods, and are subject. Tasa de cambio EUR a USD · Convertor de Moneda: 1 EUR a USD · Gane dinero en la conversión de moneda! · Gráfico online EURUSD - Euro / Dólar · Simulador de. 1 COP = USD. TO = US Dollar (USD) 1 USD = COP. COP USD. Countries using this currency: Colombia,. Countries using this currency: American samoa. More Dólar dos EUA info. COP - Peso colombiano. Nosso ranking de moedas mostra que a taxa de câmbio mais procurada para Peso colombiano é de COP para USD. 1 USD = 4, COP Sep 14, UTC The currency converter below is easy to use and the currency rates are updated frequently. This is very much. La siguiente tabla muestra la historia del tipo de cambio entre Dólar Estadounidense y Peso Colombiano ; Tuesday 2 July , 1 USD = COP, USD COP tasa. Dollar Today in Colombia. Saturday September 14, $4, 1 Day: $ (%) 1 Week: $ (%) 1 Month: $ (%).

Histórico de Taxas de Câmbio do Dólar Americano (USD) para o Peso Colombiano (COP) ; Alta: ,50 COP na sexta-feira, 28 de junho de ; Média: ,32 COP. Para hacer el cambio de tus pesos a dólares, deberás dirigirte a nuestra oficina y solicitar información a los asesores de turno. Nuestro equipo se encargará de. Cambios Vancouver • Colombia, $, $, $, –, –, 1h ago Un Dolar • Colombia, $, $, $, –, –, 20h ago • Bogota. Show. Las tasas de cambio son favorables y las comisiones mínimas. Colombia no son reconocidos como moneda de curso legal conforme con la normativa colombiana. USD to COP ; $ Dollars, = $ 4, Pesos ; $ Dollars, = $ 20, Pesos ; $ Dollars, = $ 41, Pesos ; $ Dollars, = $ 62, Pesos. ¿Cuánto vale el dólar en Bancolombia hoy? Application to know the official exchage rate of the dollar in Colombia Cómo mejora sería bueno implementar un minuto a minuto el cambio del dólar en el día. Learn the current USD to COP exchange rate and the cost when you send money to Colombia with Remitly. Precio del dólar en el año · 1 de Enero de · 31 de Diciembre de Check the current Representative Market Exchange Rate (TRM) and use our convenient built-in calculator. Discover all the features our dollar app offers. Calculator Dollars - Colombian Pesos · $ 1, dollars (USD) · $ 4,, Colombian Pesos (COP) · $ 1 USD = $ 4, COP. Quick Conversions from United States Dollar to Colombian Peso: 1 USD = 4, COP ; US$ , $ , ; US$ , $ 1,, ; US$ , $ 2,, Las tarifas y los tipos de cambio están sujetos a cambios sin previo aviso. 1 En transferencias internacionales de más de USD 15, la fecha en que el dinero. Send money to Colombia from your device to a bank account in Colombia or pick up in cash from our thousands of partner locations all over the country. Casa de cambio en Bogotá Colombia con el mejor servicio para la compra y venta de moneda extranjera. Por disposiciones legales nuestra actividad es la. Historial del tipo de cambio del dólar estadounidense (USD) al peso colombiano (COP) ; Más alto: ,56 COP el lunes, 2 de septiembre de ; Promedio: Comisión USD. Total a pagar USD. Enviar. Las tasas y comisiones corresponden a enviar desde undefined. Nuestros socios de confianza en Colombia. Get US Dollar/Colombian Peso FX Spot Rate (COP=:Exchange) real-time stock quotes, news, price and financial information from CNBC. We currently do not charge any service fees for any of our currency exchange transactions In Colombia. Remember that placing an online reservation saves you. Convertir Dólares Canadienses a Pesos colombianos ( CADCOP) · Conversor de Moneda: Dólar Canadiense a Peso Colombiano · Gane dinero en la conversión de.

1 2 3 4 5