rejekibet.ru Market

Market

Best Small Business Wireless Plans

SMALL BUSINESS UNLIMITED EVOLVED PLANS ; PLAN DISCOUNTS Available In-Store Only, Business Tablet Unlimited Data-Everyday plan for the price of the Basic Tablet. With a Spectrum Mobile Unlimited Plus data plan, you can get a new phone for your business whenever you want with FREE Anytime Upgrade. Best alternative to personal cell phone for business use? · Unitel (unitel voice) - starts at $/month. · Grasshopper - starts at $17/month. Currently, Mint Mobile offers the best value and cheapest unlimited plan we've seen. You can get four lines of unlimited data for as cheap as $60/month. The best business phone services in in full: · 1. Nextiva · 2. RingCentral · 3. Ooma Office · 4. Aircall · 5. Dialpad · 6. 8x8 · 7. rejekibet.ru There isn't one carrier or plan that we can recommend for everyone, but T-Mobile's Magenta plan is best for unlimited data, and AT&T's Unlimited Extra plan. Experience the power of Verizon's Business Unlimited, with unlimited talk, text & data, 5G, mobile hotspots, and more. Find the best business wireless plan. Get flexible business wireless plans that let you mix and match, with Unlimited starting at $25/mo. T-mobile seems to have the best pricing and Verizon the best service. I own all my devices. Any ideas on a decent service that would save me. SMALL BUSINESS UNLIMITED EVOLVED PLANS ; PLAN DISCOUNTS Available In-Store Only, Business Tablet Unlimited Data-Everyday plan for the price of the Basic Tablet. With a Spectrum Mobile Unlimited Plus data plan, you can get a new phone for your business whenever you want with FREE Anytime Upgrade. Best alternative to personal cell phone for business use? · Unitel (unitel voice) - starts at $/month. · Grasshopper - starts at $17/month. Currently, Mint Mobile offers the best value and cheapest unlimited plan we've seen. You can get four lines of unlimited data for as cheap as $60/month. The best business phone services in in full: · 1. Nextiva · 2. RingCentral · 3. Ooma Office · 4. Aircall · 5. Dialpad · 6. 8x8 · 7. rejekibet.ru There isn't one carrier or plan that we can recommend for everyone, but T-Mobile's Magenta plan is best for unlimited data, and AT&T's Unlimited Extra plan. Experience the power of Verizon's Business Unlimited, with unlimited talk, text & data, 5G, mobile hotspots, and more. Find the best business wireless plan. Get flexible business wireless plans that let you mix and match, with Unlimited starting at $25/mo. T-mobile seems to have the best pricing and Verizon the best service. I own all my devices. Any ideas on a decent service that would save me.

When you're on our Unlimited Evolved plans, the more lines you add, the more you save. Pair our Unlimited Evolved plans with a device installment promotion for. Savings comparison to weighted average of top 3 carriers based on optimized pricing. Taxes and fees extra. Comcast Business Internet required. Choose the best phone service for your business. Nextiva offers the best value, advanced features, and Amazing Service for less. Plans start at $ Best Buy customers often prefer the following products when searching for Phone Systems For Small Business. · CM Extension Deskset for VTech CM Small. Discover the best small business cell phone plans for optimized communication and cost-efficiency. Keep your team connected with reliable coverage. Catering to businesses of all sizes, they provide various solutions, including high-speed internet, VoIP, and wireless services. Best Features: AT&T Small. Ask us about device set up! US Mobile can set up your all your business devices. $10K order minimum for bulk financing options. Grow your business with plans that provide incredible value–now with more travel benefits than before. ; Business Unlimited Edge. $45 · per line for 6+ lines. If you subscribe to a RingCentral RingEX plan, each of your users gets a business phone line with a dedicated number. You can then add local, toll-free, and. Equip your teams with the best business phones for $0 down and 0% interest when you pay off the device over 24 or 36 months. Choose the best data option for each mobile phone in your business · Choose from 2 different Unlimited data options to match up with different work needs, and. AT&T offers business wireless plans with unlimited data, talk & text starting at $30/mo. Compare business cell phone plans and choose a best phone plan for. Save $50/mo when you combine select Mobile plans with a Business Phone solution and Business Internet on a 3-yr term with Auto-Pay Discount. Exclusive Member Benefits · Rogers. · Rogers – Available to small business customers on new phone activations on Rogers Infinite plans with financing at. Savings comparison to weighted average of top 3 carriers based on optimized pricing. Taxes and fees extra. Comcast Business Internet required. Choosing a good business cell phone plan can offer massive benefits to your organization. These benefits include access to unlimited talk, text, and data for. Tello, our top rated cell phone plan provider, offers nationwide coverage through T-Mobile with a range of inexpensive plan options plus the ability to. Business Cell Phone Plans are used by businesses to provide local and long-distance voice service as well as internet or data service over regular cells phones. Get our BEST smartphone plan for over 50% off when you bundle. 1 Plus, save $ when you activate an eligible smartphone plan online. 2. 5G Business Internet. Do business on your terms with wireless 5G internet that's fast, simple and secure. Plans start at $69/mo. Learn more.

Vegan Protein Without Stevia

Raw Organic Protein Powder Unflavored - No Stevia 10 Packets 1oz (28g) · USDA Organic · Non-GMO Project Verified · Informed Choice · NSF GF Certified · Kosher U · No. Looking for recommendations on vegan protein powders without stevia. TIA. Try Orgain Simple. Uses a bit of real sugar. No stevia. No artificial flavors. Another big perk is that it's low in sugar without having an overpowering Stevia flavor. I've found most non-vegan protein powders to be difficult to digest. No stevia, erythritol or added sugar. Third-party tested and results shared Most vegan protein powders don't have organic certification - meaning. Plant Protein (Sweetened with natural Stevia, No Artificial sweeteners) Similar to whey protein - Our Premium Plant Protein delivers 24gm of vegan proteins. 20g plant based protein, made with Fewer ingredients, no stevia or artificial sweeteners, gluten free, dairy free, soy free - lb. Vegan, Gluten-free; No soy or dairy ingredients. *Per serving ^Not a low calorie food. Do you make a protein powder without organic stevia or erythritol? Yes. What is the best protein powder without stevia or artificial sweetener? · Plain grass-fed whey protein · Plain organic pea protein · Plain organic hemp protein. Raw Organic Protein Powder Unflavored - No Stevia 10 Packets 1oz (28g) · USDA Organic · Non-GMO Project Verified · Informed Choice · NSF GF Certified · Kosher U · No. Looking for recommendations on vegan protein powders without stevia. TIA. Try Orgain Simple. Uses a bit of real sugar. No stevia. No artificial flavors. Another big perk is that it's low in sugar without having an overpowering Stevia flavor. I've found most non-vegan protein powders to be difficult to digest. No stevia, erythritol or added sugar. Third-party tested and results shared Most vegan protein powders don't have organic certification - meaning. Plant Protein (Sweetened with natural Stevia, No Artificial sweeteners) Similar to whey protein - Our Premium Plant Protein delivers 24gm of vegan proteins. 20g plant based protein, made with Fewer ingredients, no stevia or artificial sweeteners, gluten free, dairy free, soy free - lb. Vegan, Gluten-free; No soy or dairy ingredients. *Per serving ^Not a low calorie food. Do you make a protein powder without organic stevia or erythritol? Yes. What is the best protein powder without stevia or artificial sweetener? · Plain grass-fed whey protein · Plain organic pea protein · Plain organic hemp protein.

Always free from: gluten, dairy, soy, stevia, and sugar alcohols. Vanilla Protein Powder. Ingredients: Protein Blend* (Pea Protein*, Brown Rice Protein*, Hemp. Raw Organic Protein is a Certified Organic, Non-GMO Project Verified Raw Vegan Protein powder made with 13 Raw sprouted proteins delivering 22 grams of protein. Raw Organic Protein Original No Stevia grams container of Raw Vegan Protein Powder by Garden of Life. 28 servings per container. Raw, vegan, gluten free. Naturally-flavored and sweetened plant protein – no synthetic flavors or artificial sweeteners. · Soy-free, dairy-free, and verified vegan. · 20g of easily. PlantFusion Complete Protein offers a widely-popular “Natural” or stevia-free option and is one of the best-tasting vegan protein powder products of its kind. No bloating, no uncomfortable stomach. Naturally sweetened with stevia and thaumatin. Our innovative sweetener blend combines stevia leaf extract and thaumatin. When choosing a vegan protein powder without stevia, it is essential to look for high-quality and easily digestible protein sources. Pea protein, for example. No stevia. We use as few ingredients as necessary from the best sources And save 17% (with subscription). USDA ORGANIC | VEGAN | NON-GMO. Organic. Looking for a protein powder that's both organic and vegan? RAW Organic Protein Original has got you covered! This powder contains 13, sprouted raw proteins. Organic Plant-Based Protein & Protein Peptides · Keto Friendly · Includes Hyaluronic Acid & Biotin · % Vegan Collagen Building Ingredients · High in Vitamin C. What is the best protein powder without stevia or artificial sweetener? · Plain grass-fed whey protein · Plain organic pea protein · Plain organic hemp protein. Perfect for a post-workout protein boost, morning smoothie, or afternoon snack, Organic Vegan Protein is deliciously smooth-tasting, non-GMO. We love this plant protein with no stevia! Read more. Patti. 07/13/ Best Protein Powder! I've been using this product for years, and I love it. It mixes. Plant Protein Superfood + Adaptogens · Everything you need. for everything you do. · With nothing shady. · No Gums. No Stevia. No Soy. · Key benefits · Supports. drink wholesome is the best protein powder without artificial sweeteners or stevia. It is sweetened with either REAL maple sugar or monk fruit. Find Garden of Life Unflavored - No Stevia Raw Organic Protein, oz at Whole Foods Market. Get nutrition, ingredient, allergen, pricing and weekly sale. Clean, Organic & Delicious: Only 6 natural ingredients, no stevia, artificial sweeteners, or fillers. Ideal for those who are looking to increase their. Raw Organic Protein Powder Unflavored - No Stevia · Excellent Source of Complete Protein from 22 RAW Organic Sprouts · 22 Grams of Protein; Grams of Branched. Our vegan protein is naturally sweetened with stevia and monk fruit and doesn't contain any artificial flavors or sweeteners. Improved Digestion. Formulated. Our Chocolate Clean Plant Protein has real, organic cocoa and is sweetened ever so slightly with monk fruit only. No stevia. This deliciously smooth, vegan, not.

Best Loan For Tesla

Tesla loan rates as low as % rejekibet.ru to disclosure. Get the lowest Tesla loan rates and financing up to $, We aim to provide simple, transparent and compelling financing options for business and private use. For Tesla arranged options, we will work with our. Tesla Loan Features · Excellent competitive rates · Terms up to 84 months for new and used Teslas · Quick online application with same-day approval in most. However, there are currently only three preferred lenders that Tesla works with (Plenti, Macquarie and CBA), meaning choice is very limited. As a result, you. Find your best Tesla finance rate with Driva Compare 30+ lenders before financing your new car. Tesla is an American electric vehicle and clean energy. % Loans from Tesla When opportunity knocks, it's best not to look a gift horse in the mouth. For me, I never turn down good financing. Tesla offers the ability to purchase your vehicle by financing with a Tesla financier or customers can use a third-party financier. Through an exclusive relationship with Tesla, Eagle Community Credit Union can fund loans directly with Tesla on their delivery date—saving you time and money. Credit Union Auto Loans for Tesla in CA Can you finance a Tesla through a bank or credit union? Absolutely, and Credit Union of Southern California (CU SoCal). Tesla loan rates as low as % rejekibet.ru to disclosure. Get the lowest Tesla loan rates and financing up to $, We aim to provide simple, transparent and compelling financing options for business and private use. For Tesla arranged options, we will work with our. Tesla Loan Features · Excellent competitive rates · Terms up to 84 months for new and used Teslas · Quick online application with same-day approval in most. However, there are currently only three preferred lenders that Tesla works with (Plenti, Macquarie and CBA), meaning choice is very limited. As a result, you. Find your best Tesla finance rate with Driva Compare 30+ lenders before financing your new car. Tesla is an American electric vehicle and clean energy. % Loans from Tesla When opportunity knocks, it's best not to look a gift horse in the mouth. For me, I never turn down good financing. Tesla offers the ability to purchase your vehicle by financing with a Tesla financier or customers can use a third-party financier. Through an exclusive relationship with Tesla, Eagle Community Credit Union can fund loans directly with Tesla on their delivery date—saving you time and money. Credit Union Auto Loans for Tesla in CA Can you finance a Tesla through a bank or credit union? Absolutely, and Credit Union of Southern California (CU SoCal).

Your monthly installment payments with Tesla Finance LLC for your vehicle loan can be made conveniently in the Tesla app or your Tesla Account For the best. Tesla's lender partners provide new and used car loans with APRs ranging from % to 72 months and loan periods ranging from 36 to 72 months. We recommend. Read our guide to learn how to purchase a Tesla in the UK and the types of asset finance that work best for different models. Read our guide to learn how to purchase a Tesla in the UK and the types of asset finance that work best for different models. Star One is able to fund loans directly with Tesla on their delivery date—saving you time and money. Get the same low Tesla loan rate, even on longer terms. Drive a Tesla with a tailored car loan from Jade Finance. Enjoy better, competitive rates and fast approvals for new and used Tesla models. In January , the Department of Energy issued a $ million loan to Tesla Obama Administration Awards First Three Auto Loans for Advanced Technologies to. Scotiabank is the #1 choice when financing at the dealership Enjoy flexible payment options. Auto Loans. Manage your auto loan from almost anywhere. Use online banking to make payments, access monthly statements, and view loan activity. Enroll now. Finance your Tesla, Fisker, Rivian, Lucid Motors, or legacy brand EV with Logix and enjoy! Competitive rates. as low as % APR* for 24 months! Up to Special EV Financing Rates Available With These Featured Manufacturers · Tesla · VinFast · Lucid · KIA · Fiat-Chrysler Automobiles. Tesla financing is more affordable with no payments for 90 days. OneAZ's new auto rates put you in the driver's seat of a luxury electric vehicle. Financing your Tesla · Step 1: Shop for Your Vehicle · Step 2: Become a Member of Clean Energy Credit Union · Step 3: Review and Complete Your Loan Documents · Step. Calculate Tesla Model 3 monthly payment, amortization schedule and compare auto loan balance to expected resale value. Tesla Financing offers a fixed apr car loan product of %. Your APR can vary depending on several factors, such as your credit score. Mountain America provides competitive financing and favorable terms for all current Tesla models—3, S, X and Y. Auto Loans · Auto loan tools · Your top car questions, answered · Find the right car loan · Auto lender reviews · Upstart Auto Loan Refinancing: Review · Bank of. Consumers in the lowest credit tier for Tesla financing are those with sub scores, and here your interest rate rises to %, and month financing isn't. Get great loan rates on a new or certified pre-owned Tesla. And with Tech CU, you're banking with a credit union that has your best interests at heart. If you prefer to purchase from a private seller rather than a dealership, we may be able to help. A personal loan from U.S. Bank can give you quick access to.

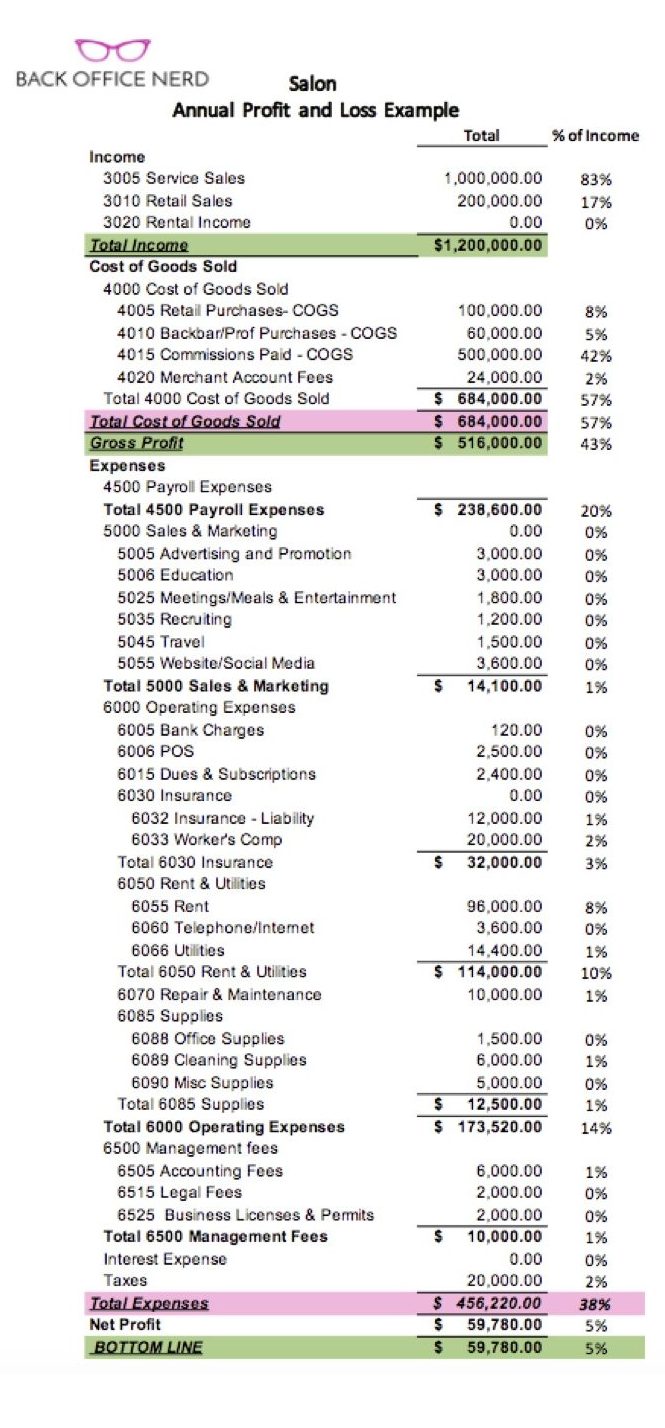

Understanding The Profit And Loss Statement

The profit and loss statement is a financial document that provides a snapshot of a business's revenues, costs, and expenses over a specific period of time. One of the most fundamental questions first-time startup founders have about the three basic financial statements is, “Is profit and loss the same as income. The P&L statement provides a breakdown of revenue generated and expenses incurred. This allows you to see how profitable your business is and how much money is. What is P&L in business? A profit and loss statement details the income and profitable; it's key to understanding the financial health and. The P&L statement provides a breakdown of revenue generated and expenses incurred. This allows you to see how profitable your business is and how much money is. A profit and loss (P&L) statement details the revenue, expenses, and costs from a specific time period to show net profits. Also called an income statement. The profit and loss statement typically includes three sections: revenue, expenses, and net income. Revenue represents the total amount of money. Profit and loss statement (definition). A profit and loss statement is a financial report that shows how much your business has spent and earned over a. The P&L statement shows a company's ability to generate sales, manage expenses, and create profits. It is prepared based on accounting principles that include. The profit and loss statement is a financial document that provides a snapshot of a business's revenues, costs, and expenses over a specific period of time. One of the most fundamental questions first-time startup founders have about the three basic financial statements is, “Is profit and loss the same as income. The P&L statement provides a breakdown of revenue generated and expenses incurred. This allows you to see how profitable your business is and how much money is. What is P&L in business? A profit and loss statement details the income and profitable; it's key to understanding the financial health and. The P&L statement provides a breakdown of revenue generated and expenses incurred. This allows you to see how profitable your business is and how much money is. A profit and loss (P&L) statement details the revenue, expenses, and costs from a specific time period to show net profits. Also called an income statement. The profit and loss statement typically includes three sections: revenue, expenses, and net income. Revenue represents the total amount of money. Profit and loss statement (definition). A profit and loss statement is a financial report that shows how much your business has spent and earned over a. The P&L statement shows a company's ability to generate sales, manage expenses, and create profits. It is prepared based on accounting principles that include.

A profit and loss statement (commonly called a P&L) is a financial document that measures your expenses and sales during a certain time period. The profit and loss account forms part of a business' financial statements and shows whether it has made or lost money. It summarises the trading results of a. The profit and loss (P&L) statement is a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period. A P&L statement (sometimes called a statement of operations) is a type of financial report that tells you how profitable your business was over a given. A profit and loss (P&L) statement is a financial report that summarizes a business's total income and expenses for a specific period. The P&L statement shows a company's ability to generate sales, manage expenses, and create profits. It is prepared based on accounting principles that include. The main purpose of your P&L is to list all your income and expenses, and the difference between the two. That's your profit or loss – and how you know whether. Here are some key terms for you to review as you explore Profit and Loss Statements. Profit and Loss Statement (P&L): also known as an Income Statement;. The P&L statement is a financial statement that summarizes those three factors. The goal of every organization is to generate profit while keeping losses as low. A profit and loss statement, also known as a P&L statement, measures a company's sales and expenses during a specified period of time. Learn about profit and loss statements and how they help investors evaluate a company's financial condition and prospects for future growth. At its core, a P&L statement is a type of financial statement that summarizes a company's revenues, costs, and expenses during a specific period of time. P&L Statement contains a company's revenues, expenses and net profit for a particular period. This chapter covers the essentials topics in the statement. P&L statements can be done for any given period of time, but it's helpful to review your P&L monthly or at least quarterly. How to Create a P&L Statement. If. Summary · The income statement presents revenue, expenses, and net income. · The components of the income statement include: revenue; cost of sales; sales. What is a profit and loss statement (P&L)?. A profit and loss statement (P&L), also called an income statement or statement of operations, is a financial report. What is a P&L Statement? A P&L statement is a document that compares the total income of a business against its debt and expenses. A P&L statement is an. One of the most important financial tools that will help you understand the financial health of your company is your business's profit & loss statement. This. The Profit & Loss (P&L) report is a window into your business, providing a Understanding an organization's income statement is essential for all. The profit and loss (P&L) statement outlines a company's revenues, costs and expenses over a specified period.

What Are Jobs That Can Make You Rich

There are a few industries that offer the opportunity to become very rich. Perhaps one of the biggest is finance. There is potentially lots of money to be made. jobs. You can sign up for premium-level access to our database of hand-screened job listings, as well as job search and career webinars, and many other. A wide variety of high-paying careers for graduates of all degree levels exist, but you must know where to look for and how to pursue them. We help people, businesses and institutions build, preserve and manage wealth so they can See how you can make meaningful contributions as a student or recent. Sales jobs are renowned for coming with good salaries, commission packages and other bonuses and perks. Social media director and manager roles can be one of the happiest careers for socially-minded individuals. Degree and Training Required: Undergraduate degrees. In conclusion, getting rich with a normal job by 30 is possible with hard work and smart planning. Start by understanding basic math, finding a. Half of doctors in the US earn over $, per year, and the mean is actually higher than finance and law. That said, the very highest-earning people are in. Sales Consultant – Sales jobs aren't known for their high salaries but if you sell the right thing and sell it well, you can make several hundred thousand just. There are a few industries that offer the opportunity to become very rich. Perhaps one of the biggest is finance. There is potentially lots of money to be made. jobs. You can sign up for premium-level access to our database of hand-screened job listings, as well as job search and career webinars, and many other. A wide variety of high-paying careers for graduates of all degree levels exist, but you must know where to look for and how to pursue them. We help people, businesses and institutions build, preserve and manage wealth so they can See how you can make meaningful contributions as a student or recent. Sales jobs are renowned for coming with good salaries, commission packages and other bonuses and perks. Social media director and manager roles can be one of the happiest careers for socially-minded individuals. Degree and Training Required: Undergraduate degrees. In conclusion, getting rich with a normal job by 30 is possible with hard work and smart planning. Start by understanding basic math, finding a. Half of doctors in the US earn over $, per year, and the mean is actually higher than finance and law. That said, the very highest-earning people are in. Sales Consultant – Sales jobs aren't known for their high salaries but if you sell the right thing and sell it well, you can make several hundred thousand just.

As you increase your rates, you can make more money in less time. That allows you to work fewer hours and gives you more time to invest toward other dreams. Working on Wall Street could mean you're an investment banker, fund manager, or media star. Read what it takes to land a high-paying Wall Street job. 1. You're Building Someone Else's Wealth. When you are working for someone else, you are essentially building their business. · 2. Time Is Greater Than Money · 3. Half of doctors in the US earn over $, per year, and the mean is actually higher than finance and law. That said, the very highest-earning people are in. Chauffeur · $65, per year · chauffeur jobs ; Concierge · $45, per year · concierge jobs ; Personal assistant · $50, per year · personal assistant jobs. It just won't happen quickly, which is perfectly fine, especially if you like your job. You don't need to start a business to build wealth if you set up a. 2. Personal finance advisor Personal finance advisors are some of the highest paying finance jobs. These financial experts help clients make strategic. Jobs That Will Make You Rich. 8. Jan. · Senior iOS Developer. Apps aren't going away - and neither are the people · Customer Success Support Engineer. 1. Chief Executive Officer (CEO) Topping the list, being a CEO gets you the highest paying job in the world, no matter where you work. 15 Best Sales Jobs That Pay Well · Vice President of Sales · Sales Engineer · Enterprise Sales Executive · Regional Sales Manager · Pharmaceutical Sales. You might be called upon to sit in the car for hours waiting for the "principal," as servant's employers are typically called. Personal drivers earn about. Highest and Lowest Paying Jobs in the U.S. · Surgeon — $, · General practice physician — $, · Psychiatrist — $, · Orthodontist — $, There are a few industries that offer the opportunity to become very rich. Perhaps one of the biggest is finance. There is potentially lots of money to be made. jobs. You can sign up for premium-level access to our database of hand-screened job listings, as well as job search and career webinars, and many other. And life is not like that. Don't get me wrong — there are things you can learn from everybody's story. However, what will work for you has to be. In conclusion, getting rich with a normal job by 30 is possible with hard work and smart planning. Start by understanding basic math, finding a. “What matters is if someone has a willingness to do a job well and the ability to learn how to get to that point,” she said. “You can basically learn about and. You might be called upon to sit in the car for hours waiting for the "principal," as servant's employers are typically called. Personal drivers earn about. jobs and the steps you can take to achieve your professional goals. Let's Relevant work experience is the gold standard, but the IT industry has a wealth. Architectural and engineering managers make an annual average salary of USD , Depending on their company's pay structure, they may also earn an average.

Apps U Can Borrow Money From

Cash advance apps – also called payday advance apps – allow you to borrow money in advance of your paycheck. A new player in the field — earned income, or wage. SoLo is a community finance platform where our members step up for one another. Borrow, lend and bank on your terms and no mandatory fees. Get an Instant Cash advance*, build credit**, save money, and track your spending – all on Brigit. Join over 8 million users on the financial health & budget. Varo Cash Advance · Get up TO $ to COVER THAT · Borrow what you need. Right when you need it. · Borrow fast · SO, CAN I JUST BORROW $ RIGHT AWAY? With Lenme, you get instant access to lenders willing to compete to lend to you. Unlike others, Lenme lenders will offer you a rate you deserve, regardless of. Users connect their bank account and employment details to the app, which then calculates how much they can borrow money until payday based on. EarnIn lets you access your pay as you work — not days or weeks later. All with no loans, no borrowing money, no interest, no mandatory fees, and no credit. A paycheck advance app allows you to use your smartphone to borrow money in between paychecks. Instead of running a credit check, the app will review your bank. EarnIn is a cash advance app available on both Apple and Android devices. It offers cash advances of up to $ per pay period and operates on a tip-based. Cash advance apps – also called payday advance apps – allow you to borrow money in advance of your paycheck. A new player in the field — earned income, or wage. SoLo is a community finance platform where our members step up for one another. Borrow, lend and bank on your terms and no mandatory fees. Get an Instant Cash advance*, build credit**, save money, and track your spending – all on Brigit. Join over 8 million users on the financial health & budget. Varo Cash Advance · Get up TO $ to COVER THAT · Borrow what you need. Right when you need it. · Borrow fast · SO, CAN I JUST BORROW $ RIGHT AWAY? With Lenme, you get instant access to lenders willing to compete to lend to you. Unlike others, Lenme lenders will offer you a rate you deserve, regardless of. Users connect their bank account and employment details to the app, which then calculates how much they can borrow money until payday based on. EarnIn lets you access your pay as you work — not days or weeks later. All with no loans, no borrowing money, no interest, no mandatory fees, and no credit. A paycheck advance app allows you to use your smartphone to borrow money in between paychecks. Instead of running a credit check, the app will review your bank. EarnIn is a cash advance app available on both Apple and Android devices. It offers cash advances of up to $ per pay period and operates on a tip-based.

A money lending app will provide you with a cash advance, which is meant to act as a bridge to your next payday and will require repayment in one lump sum. This. Chime SpotMe is a financial app that offers cash advances up to $ It emphasizes its fee-free approach to borrowing money. Play Store. EarnIn is an app that gives you access to the pay you've earned - when you want it. Get paid for the hours you've worked without waiting for payday. The relationship-based lending app, reenvisioning the way friends and family lend and borrow money. 6 cash advance apps to borrow money until payday · EarnIn · Empower · Brigit · Current · MoneyLion · Dave. Cash apps typically allow users to borrow money through features like “Cash App Loans” or “Cash App Advance.” This service provides users with a short-term. Why we chose Possible: Possible Finance offers almost identical loan products as SoLo Funds. The Possible Loan can help borrowers avoid paying the astronomical. Notable among them is Kotak Mahindra Bank's mobile app. Through this app, users can easily apply for personal loans with minimal documentation. Loan or Borrow Money with Friends & Family. Mixing money and relationships can be awkward. Try the Pigeon App. Get Started TodaySchedule A Walkthrough. A copy of the Cash App Terms of Service, and related policies, can be found here. The best cash advance apps have low fees and high borrowing limits, provide great service, and won't overdraft your account. Our top choice is Varo. 7 Loan Apps to Consider · Chime. · Dave. · Brigit. · Albert. · EarnIn. · MoneyLion. · Possible Finance. Best Loan Apps Of September ; BEST OVERALL LOAN APP FOR CASH ADVANCES. EarnIn. EarnIn ; BEST FOR ALL-IN-ONE BANKING. Chime®. Chime® ; BEST FOR CHECKING AND. Get cash when you need it. With ExtraCash™ from Dave, you can get ExtraCash It takes only minutes to download the Dave app, securely link your bank. This feature lets you borrow up to $ interest-free. When you first qualify, you can receive advances of up to $20 and build your limit from there. Notable. Cash Advance Apps: Apps like PayDaySay, Dave, and Brigit can provide small cash advances quickly. While you've probably considered these, they. How can I borrow money from Cash App? To borrow money from Cash App, you need to check your eligibility, open the app, navigate to the ". With an eligible Fifth Third checking account, you can take a cash How much will I be able to borrow? Your credit limit can range from $50 to. So far, we've talked about money lending apps like Dave and Albert that can get you quick cash when you need it, but they also chuck yet another monthly. Easy way to borrow, save, invest, and earn. All in one app. Varo. Online bank accounts with no minimum balance.

Whats Better Square Or Clover

I also like the fact that Square is solely focused on helping the merchants, whereas Clover built a market for developers to create apps for. Square has slightly better customer service and is less likely to hold or freeze your money. PayPal is best for mobile in-person transactions because of its. Clover has a lot of hidden fees. Customer support takes forever and it is outsourced. $ in transactions and they hit me with a $ fee. What is included with full warranty vs. a limited warranty or Clover Care? A You select the right combination of hardware and software solutions to help you. With so much in common it's hard to decide which is best, but after testing both I think Square is better than SumUp. Square has a wider range of hardware. In a Clover vs. Square standoff, the biggest difference is the flexibility and variety of out-of-the-box features you get with Clover. While Square has a slew. Its POS software and payment processing tools tend to be more flexible and customizable than Square's, which is designed to maximize simplicity. Clover also. Clover holds a rating of and excels in. It provides a balanced mix of affordability and advanced features, making it suitable for a wide range of business. In this blog, we will see the difference between Clover and Square based on several factors so you can decide which is better for you! I also like the fact that Square is solely focused on helping the merchants, whereas Clover built a market for developers to create apps for. Square has slightly better customer service and is less likely to hold or freeze your money. PayPal is best for mobile in-person transactions because of its. Clover has a lot of hidden fees. Customer support takes forever and it is outsourced. $ in transactions and they hit me with a $ fee. What is included with full warranty vs. a limited warranty or Clover Care? A You select the right combination of hardware and software solutions to help you. With so much in common it's hard to decide which is best, but after testing both I think Square is better than SumUp. Square has a wider range of hardware. In a Clover vs. Square standoff, the biggest difference is the flexibility and variety of out-of-the-box features you get with Clover. While Square has a slew. Its POS software and payment processing tools tend to be more flexible and customizable than Square's, which is designed to maximize simplicity. Clover also. Clover holds a rating of and excels in. It provides a balanced mix of affordability and advanced features, making it suitable for a wide range of business. In this blog, we will see the difference between Clover and Square based on several factors so you can decide which is better for you!

Square is an all-in-one solution with simple pricing, but Clover allows you to set up your own merchant account. Many or all of the products. Clover has just the right combination of affordability with extra features and flexibility that isn't offered by some cheaper options. Clover is flexible enough. gives Square a competitive edge. Square vs. Clover · Square vs. Gusto · Square vs. Micros · Square vs. Shopify · Square vs. Stripe · Square vs. Toast · Square. Integrate with Clover devices designed for brick-and-mortar locations · Pass information about the transaction to the Clover payment app. · Establish the USB. Clover is easier to use than Square, and its catalog of industry-specific features makes it the best POS for established retail stores or restaurants. However. M publications. Découvre des vidéos liées à Square Vs Clover Pos sur TikTok. Découvre plus de vidéos en lien avec «Rougail Saucisse Fbtm, Océane Votre. Is it easy to switch and migrate from Shopify POS to Square POS? Yes, you companies. Square Compare Hub · Square vs. Clover · Square vs. Toast · Square vs. The top three of Clover's competitors in the POS Systems category are Square with %, Toast with %, Lightspeed with % market share. Clover vs. We were impressed that Square's POS software is free, which is incredibly helpful for startups and other businesses that would benefit from a free POS system. Clover wins this round. Although Clover's upfront costs can be higher than Square's, Clover delivers industry-specific necessities and takes the guesswork out. Square is suitable for small businesses where the transactions do not involve any complex processes when comparing the two. In contrast, bigger businesses can. Our Clover vs Square comparison shows that Square is cheaper to get started with, while Clover offers a more complete and robust POS solution with 's. Compatibility: Compatibility: iOS 10 (Bluetooth LE required) and Android (and higher). Clover Go dock stand without a Clover Go device. Countertop. Which one is the right option for your business? Toast vs. Square vs. Clover is a three-way POS dance for the ages, but research reveals that. For feature updates and roadmaps, our reviewers preferred the direction of Square Point of Sale over Clover. Pricing. Entry-Level Pricing. Clover. No pricing. Sell anywhere. Diversify revenue streams. Streamline operations. Manage your staff. Get paid faster. Sign up for Square today. Square is cheaper to get started, while Clover offers more flexibility. Which one is better for your small business? Find out how they compare. Square vs. Not much to like about Clover. It gets businesses with its cheap entry pricing and variable processing rates sound good but in reality it will bleed you dry. Square Point of Sale is a POS solution for Android and iOS devices which includes tools for managing payments, digital receipts, Clover is an all-in-one.

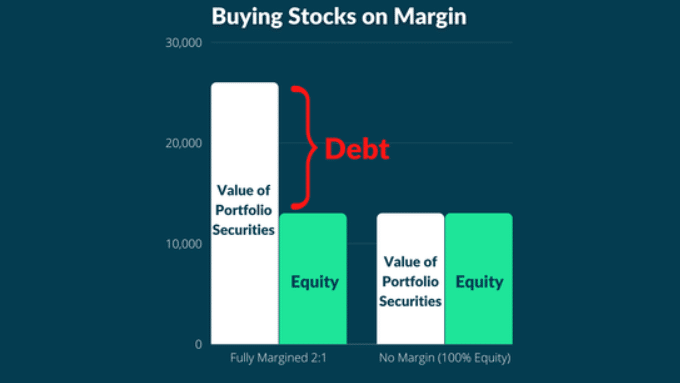

Borrowing Money To Buy Stocks

Borrow against your portfolio to buy securities or for quick access to cash for shorter-term needs. Start borrowing with only $2, in cash or marginable. People most commonly borrow on margin in order to purchase stocks, but other securities can also be purchased, including ETFs, mutual funds, bonds and options. Margin loans typically require a minimum of $2, in cash or marginable securities and generally are limited to 50% of the investments' value. Interest rates. After you enable Stock Lending, if we borrow your stock, you're paid monthly for the loan. If your stocks are on loan, you can still sell them at any time and. Borrowing to invest means you can deploy large amounts of capital either all at once or over a period of time. An alternative strategy is to convert the fully-amortizing mortgage into one that is interest-only, investing the cash flow savings in an indexed stock fund – a. You can borrow against value in the securities you already own to make additional investments and access sophisticated investment strategies, including option. The answer is simple. You can simply borrow money to invest in shares. Though you can take out a loan to invest in shares, should you? No, it is not generally recommended to take out a loan to invest in the stock market, especially with a high-interest loan like a personal loan. Borrow against your portfolio to buy securities or for quick access to cash for shorter-term needs. Start borrowing with only $2, in cash or marginable. People most commonly borrow on margin in order to purchase stocks, but other securities can also be purchased, including ETFs, mutual funds, bonds and options. Margin loans typically require a minimum of $2, in cash or marginable securities and generally are limited to 50% of the investments' value. Interest rates. After you enable Stock Lending, if we borrow your stock, you're paid monthly for the loan. If your stocks are on loan, you can still sell them at any time and. Borrowing to invest means you can deploy large amounts of capital either all at once or over a period of time. An alternative strategy is to convert the fully-amortizing mortgage into one that is interest-only, investing the cash flow savings in an indexed stock fund – a. You can borrow against value in the securities you already own to make additional investments and access sophisticated investment strategies, including option. The answer is simple. You can simply borrow money to invest in shares. Though you can take out a loan to invest in shares, should you? No, it is not generally recommended to take out a loan to invest in the stock market, especially with a high-interest loan like a personal loan.

Margin loans allow you to use your shares or managed funds as security against the money you borrow. However, if the value of your investment falls below a. These loans are typically called margin loans. The investments in your account are used as collateral for the loan. You may use the money that you borrow for. For example, if interest rates go up, some investors might sell off stock and use that money to buy bonds. When you buy stocks on margin, you borrow. If you intend to purchase securities - such as stocks, bonds, or mutual funds - it's important that you understand before you invest that you could lose some or. See if an investment loan is right for you. CIBC highlights the scenarios in which borrowing to invest may work. Learn about taking out a loan to grow your. Margin loans typically require a minimum of $2, in cash or marginable securities and generally are limited to 50% of the investments' value. Interest rates. You retain full ownership rights and may sell your shares or leave the program at any time. Keep any gains (or losses) while the stock is on loan. Earn daily. You can have purchasing power to buy more securities, make a large purchase, or use as a bridge loan for short-term liquidity needs. You can access cash without. Buying on margin is borrowing money from a broker to purchase stock. You can think of it as a loan from your brokerage. Share market investing risks · While borrowing to invest more money in shares, managed funds and ETFs increases your potential returns, it can also increase. Margin loans. A margin loan lets you borrow money to invest in shares · Investment property loans · Shop around for the best investment loan · Don't get the. Buying on margin is borrowing money from a broker in order to purchase stock. You can think of it as a loan from your brokerage. Margin trading allows you to. You can take out a loan to invest in the stock market. Just remember that the stock market is full of risk. Stock lending rates can range from a few basis points for easy-to-borrow stocks to over 5% per year for hard-to-borrow stocks. Typically, growth stocks attract. A traditional lender such as a bank will not give you a loan so you can use the money to invest in the stock market. If the stock shares you buy with. You can take out a margin loan to invest in shares. A margin loan allows you to buy shares by paying only a fraction of the cost of the shares upfront, and the. OCC's Market Loan Program is a program whereby OCC processes and maintains stock loan positions that have originated through a Loan Market. OCC acts as Central. stocks in the account. Buying on margin works the same way as borrowing money to buy a car or a house, using a car or house as collateral. Moreover. You retain full ownership rights and may sell your shares or leave the program at any time. Keep any gains (or losses) while the stock is on loan. Earn daily. Marketable securities financing can be approved against a variety of assets. You can borrow against them up to a certain percentage of their market value.

Little General Insurance Company

Our life insurance companies, Banner Life and William Penn, offer the best term policies with affordable coverage to help protect your family's future. The Little League Player Accident Policy, underwritten by National Union Fire Insurance Company (a member company of AIG) is an excess coverage, accident only. The General Insurance, Nashville, Tennessee. likes · talking about this. We offer affordable rates and a flexible approach to how and when. How will you know if you have too much or too little coverage? Both can be detrimental to you and your finances. That's why we offer up another great resource. Whether you need to obtain a quote for car insurance, make a payment, view your ID Card(s), or submit a claim; The General's mobile app makes it easy for you! The general insurance company is a joke. It took so long for them to approve Was a little uncertain at first but with the rate quoted couldn't pass it up. The General Car Insurance Offers Low Rates & Instant ID Cards to U.S. Drivers. The General Insurance. Info & Quotes on Auto Insurance - The General. little or no car insurance. UM/UIM can offer peace of mind in case you're in Compare car insurance rates from different companies instantly using our. We have access to leading insurance companies, ensuring we can find the right insurance coverage for your unique needs. Our life insurance companies, Banner Life and William Penn, offer the best term policies with affordable coverage to help protect your family's future. The Little League Player Accident Policy, underwritten by National Union Fire Insurance Company (a member company of AIG) is an excess coverage, accident only. The General Insurance, Nashville, Tennessee. likes · talking about this. We offer affordable rates and a flexible approach to how and when. How will you know if you have too much or too little coverage? Both can be detrimental to you and your finances. That's why we offer up another great resource. Whether you need to obtain a quote for car insurance, make a payment, view your ID Card(s), or submit a claim; The General's mobile app makes it easy for you! The general insurance company is a joke. It took so long for them to approve Was a little uncertain at first but with the rate quoted couldn't pass it up. The General Car Insurance Offers Low Rates & Instant ID Cards to U.S. Drivers. The General Insurance. Info & Quotes on Auto Insurance - The General. little or no car insurance. UM/UIM can offer peace of mind in case you're in Compare car insurance rates from different companies instantly using our. We have access to leading insurance companies, ensuring we can find the right insurance coverage for your unique needs.

What do I need to know about insurance claims? claims. Blue auto icon. How does car insurance work? In general, you pay your insurance company and in return. Austin Little Insurance · John Long · Adam Copyright © Florida Farm Bureau General Insurance Company; Florida Farm Bureau Casualty Insurance Company. Some car insurance companies offer telematics apps that track your driving and provide usage-based discounts. Our car insurance study found that USAA offers the. Shop The General® car insurance and get a free quote today. Explore our auto insurance options to find the coverage you need at affordable rates. The General Automobile Insurance Services, Inc., or simply The General, is a licensed insurance agency that is a subsidiary of PGC Holdings Corp. that. The General Insurance, Nashville, Tennessee. likes · talking about this. We offer affordable rates and a flexible approach to how and when. We are a privately owned independent insurance agency in Huxley, Iowa. Our associates have been guiding the financial wellbeing of businesses, and families. Clearcover is the smarter auto insurance company that's fast, hassle-free and easy to understand and helps you save money. Get your car insurance quote. Give a little info, get a lot of insight. Enter some details, then It seems like there's as many car insurance companies out there as there are cars. Products underwritten by Nationwide Mutual Insurance Company and Affiliated Companies. To chat, please give us a little information. Name. How can we. The General is a licensed car insurance agency based in Nashville, Tennessee. It's a subsidiary of PGC Holdings Corp. (PGC), and is known for offering auto. Compare Insurance Quotes with General Insurance Agency. We ensure our policies cover all those little details for total peace of mind. Saving money is a vital. It can take as little as three months to as long as six years to see a No standard car insurance company will advertise “no deposit auto insurance. We'll also need to know a little about you and your driving history. State Farm (including State Farm Mutual Automobile Insurance Company and its. Complexity and lack of transparency in car insurance pricing keep consumers from knowing which car insurer charges a lot and which one charges a little. National General, an Allstate company, is one of the largest insurers in the United States. We're proud to have been helping people insure what matters most. Affordable Car Insurance near you. Direct Auto Insurance in Little Individual term life insurance by Direct General Life Insurance Company, Nashville, TN. Umbrella Insurance policies provide coverage of $1 million or more to protect you in the event you are sued for a car accident or injury related to your. Whether you live in Little Rock or Fayetteville, Liberty Mutual can help you save on car insurance! insurance company they know they can trust. Let us. In my recent Law Journal article, "A Dirty Little Secret in Car Insurance: Can lawyers Lead a Change? companies, including those with very familiar.

Bank Rates For Home Loans

Today's competitive mortgage rates ; year fixed · % · % · ; year fixed · % · % · ; 5y/6m ARM · % · % · Mortgage Refinance Rates ; Yr Refinance · %, %, % ; Yr FHA · %, %, %. On Wednesday, September 04, , the current average interest rate for the benchmark year fixed mortgage is %, declining 2 basis points from a week ago. Fremont Bank offers best-in-class rates on mortgages, refinance and home equity lines of credit. Check out our rates and contact us today for more. Know what the current mortgage interest rates are today, or get your own custom home mortgage rate. Compare 30 and 15 years fixed mortgage rates and more. Today's Mortgage Rates ; %, %, , $4, ; %, %, , $3, Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet. Chase offers mortgage rates, updated daily Mon-Fri, with various loan types. Review current mortgage rates, tools, and articles to help choose the best. The following tables are updated daily with current mortgage rates for the most common types of home loans. Search for rates by state or compare loan terms. Today's competitive mortgage rates ; year fixed · % · % · ; year fixed · % · % · ; 5y/6m ARM · % · % · Mortgage Refinance Rates ; Yr Refinance · %, %, % ; Yr FHA · %, %, %. On Wednesday, September 04, , the current average interest rate for the benchmark year fixed mortgage is %, declining 2 basis points from a week ago. Fremont Bank offers best-in-class rates on mortgages, refinance and home equity lines of credit. Check out our rates and contact us today for more. Know what the current mortgage interest rates are today, or get your own custom home mortgage rate. Compare 30 and 15 years fixed mortgage rates and more. Today's Mortgage Rates ; %, %, , $4, ; %, %, , $3, Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet. Chase offers mortgage rates, updated daily Mon-Fri, with various loan types. Review current mortgage rates, tools, and articles to help choose the best. The following tables are updated daily with current mortgage rates for the most common types of home loans. Search for rates by state or compare loan terms.

Today. The average APR on a year fixed mortgage sits at %. Last week. %. year fixed.

View daily mortgage and refinance interest rates for a variety of mortgage and home loans from Truist. Including rates for fixed, adjustable, FHA & VA. See more Conforming Loans ; No, 15 Year Fixed, %, %, 0 ; No, 20 Year Fixed, %, %, 0 ; No, 25 Year Fixed, %, %, 0. View the daily rates for our mortgage products. We can help you go from dream to reality. Monthly principal and interest payments will be $ with a corresponding interest rate of %. Disclosures: The CommunityWorks program is only available. Today's competitive mortgage rates ; year · % · % ; year · % · % ; year · % · % ; 10y/6m · % · % ; 7y/6m · % · %. Today's competitive rates† for fixed-rate mortgages ; year · % · % ; year · % · % ; year · % · %. Conventional Mortgage Loans ; 7/6m ARM. Adjustable-Rate, Conventional. %. Rate. %. APR* ; REFINANCE ; Year. Fixed-Rate, Conventional. %. Rate. An escrow (impound) account is required. The rate lock period is 60 days and the assumed credit score is At a % interest rate, the APR for this loan. Today's Mortgage Rates. Mortgage rates change daily based on the market. Here are today's mortgage rates. Today's loan purchase rates ; VA Purchase Loan, InterestSee note%, APRSee note2 %, Points ; VA Jumbo Purchase Loan, InterestSee note1 %, APR. National year fixed mortgage rates go up to %. The current average year fixed mortgage rate climbed 2 basis points from % to % on Monday. Today's competitive mortgage rates ; year fixed · % · % · ; year fixed · % · % · ; 5y/6m ARM · % · % · What's your personalized mortgage rate? Home loan interest rates are calculated using details unique to everyone. They include your loan amount, how much. New home purchase ; year fixed mortgage · % · % ; % first-time-homebuyer · % · %. Get Today's current mortgage and refinance interest rates and compare a variety of Pennymac loan products, including VA, fixed, ARM, Jumbo and more. Explore today's mortgage rates and compare home loan options. When you're ready to apply, call Navy Federal at and get pre-approved for a. Customized mortgage rates ; 7/6 ARM, % (%), $2, ; year fixed, % (%), $ ; year fixed, % (%), $ ; year fixed, % . *** 5/5 fixed-to-adjustable rate: Initial % (% APR) is fixed for 5 years, then adjusts every five years based on an index and margin. For a year. Current Rates: Mortgage Purchase Rates, Mortgage Refi Rates, Vehicle Loans Rates, Personal Loans Rates, Home Equity Rates, Student Loans Rates, Credit Cards. Here are today's mortgage rates in. Take the next step by getting a personalized quote in as quick as 3 minutes with no impact to your credit score.

1 2 3 4 5 6